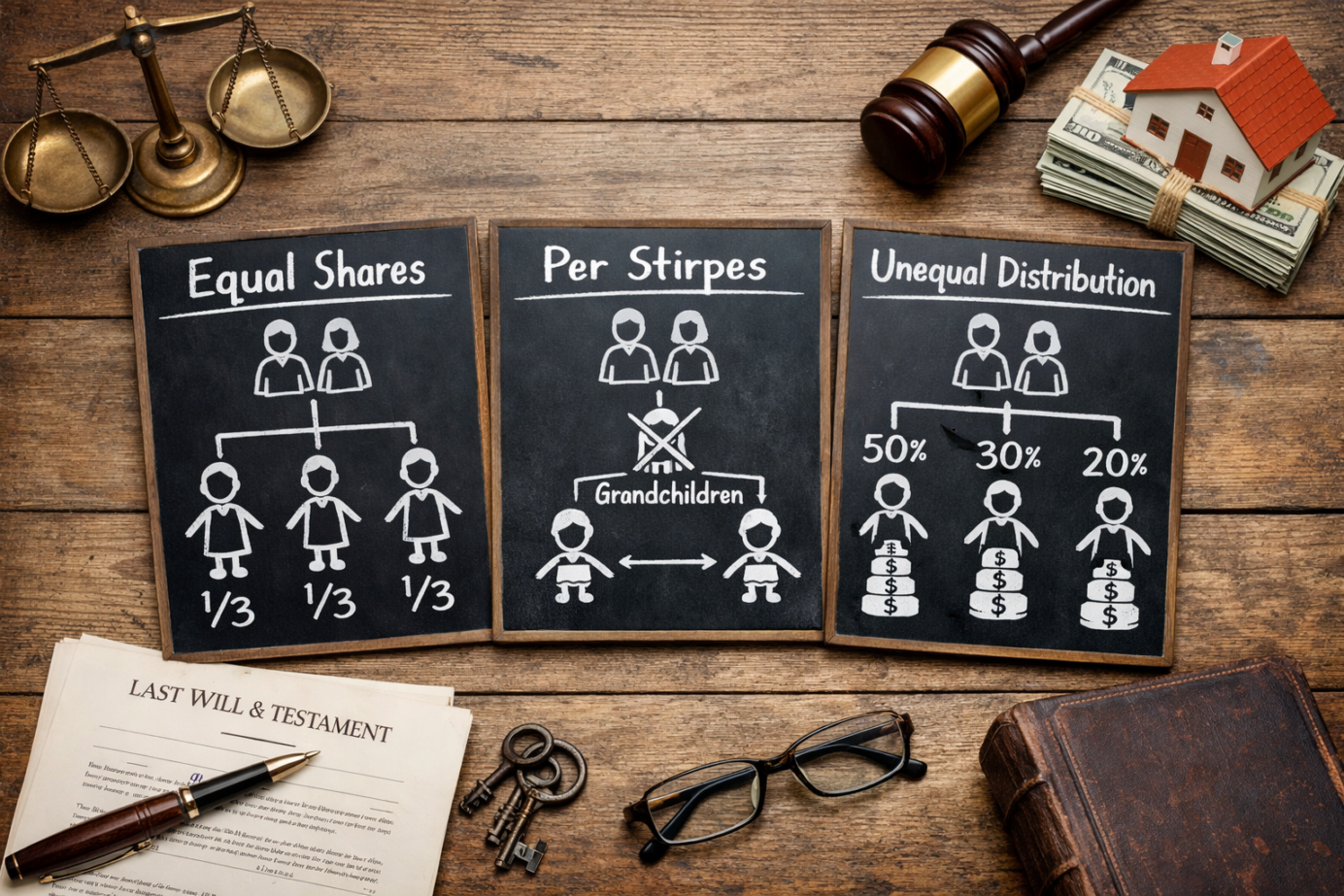

When preparing a will in Ontario, one small clause can completely change how your estate is distributed. Two of the most commonly misunderstood terms are per stirpes and per capita — and choosing the wrong one can unintentionally disinherit children or grandchildren. If you are creating or updating a will in Toronto or the Greater Toronto Area, understanding the difference … Read More

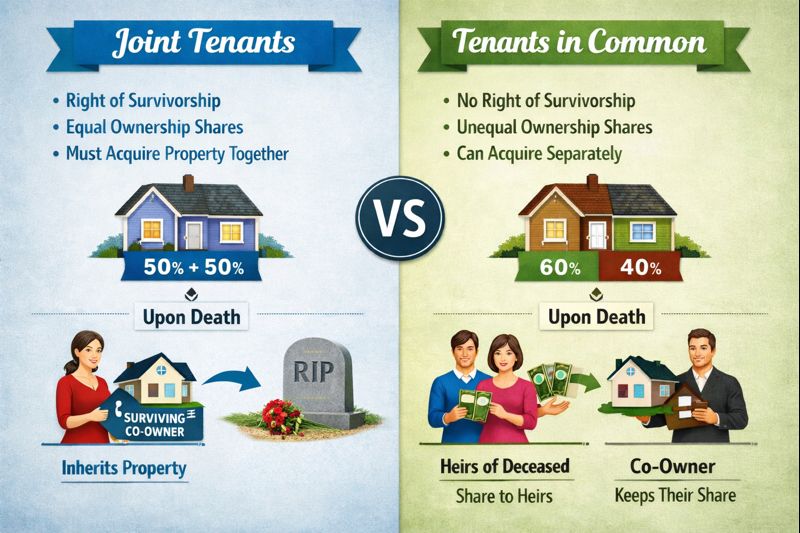

Tenants in Common or Joint Tenants? Which Ownership Structure is Right for You?

In Ontario, the terms “tenant in common” and “joint tenants” refer to different types of ownership arrangements for real property. The key differences between these two types of ownership are related to how the property is shared, what happens when one owner dies, and how ownership interests are transferred. Whether you are purchasing a property in Toronto to live in … Read More

What Toronto Contractors Need to Know About Placing a Lien When You Haven’t Been Paid

As a contractor in Toronto, few situations are more frustrating than completing work on a project—whether it’s residential, commercial, or industrial—only to find that payment is delayed or withheld. Fortunately, Ontario’s Construction Act gives contractors, subcontractors, and suppliers a powerful legal tool: the right to place a construction lien on the property where the work was performed. A lien protects … Read More

Buying in Toronto? Why It’s Crucial to List All Included Items in Your Agreement of Purchase and Sale

When buying a home in Toronto, the excitement of finding the perfect property can sometimes overshadow the finer details of the transaction. One of the most commonly overlooked—but critically important—elements of an Agreement of Purchase and Sale (APS) is the list of chattels and fixtures that will be included in the purchase. What Are Chattels and Fixtures? • Fixtures are … Read More

Should You Contact a Real Estate Agent or Real Estate Lawyer First?

This post has been made in conjunction with our good friends at Above Realty – a real estate brokerage serving Toronto and the surrounding areas that does not charge commission and covers your legal fees. Visit them at aboverealty,ca to find out more. If you’re thinking about buying a property in Ontario, one of the first questions you may have … Read More

Airbnb Property Owners Beware: Ontario Court Says You Owe HST on Sale

In 1351231 Ontario Inc. v. The King (2024 TCC 37), the Tax Court of Canada (TCC) held that a condo initially used for long-term rentals but later listed on Airbnb did not qualify as a “residential complex” under the Excise Tax Act (ETA), making its sale subject to HST. The corporation had purchased the unit in 2008, treating it as … Read More

The Hidden Risks of Pre Construction Homes in Toronto

Thinking About Buying Pre Construction in Toronto? Read This First. The appeal of buying a pre construction home in Toronto, Ontario is undeniable — modern finishes, customization options, and the sense of getting in on the “ground floor” of a new development. But while glossy brochures and show suites highlight the potential, they often leave out the risks. Many buyers … Read More

Why Buying Pre-Construction in Toronto Can Be a Smart Move

Thinking about buying a pre-construction condo or home in Toronto? Learn the top advantages of investing early in new developments across the GTA. ________________________________________ Why Buying Pre-Construction in Toronto and the GTA Makes Sense Toronto’s real estate market continues to evolve, and buying pre-construction has become an increasingly popular option for homebuyers and investors alike. Whether you’re looking for a … Read More

Title Searches in Toronto – Why they Are Important

A title search in Ontario is the process of examining public records to confirm the legal ownership of a property and to identify any encumbrances, liens, easements, or other issues that may affect the title. It is typically conducted by a real estate lawyer or a title searcher through Ontario’s land registry system (Teranet). Whether you are buying a home … Read More

Power of Attorney – Do You Need One?

In Ontario, a Power of Attorney (POA) is a legal document that allows you to appoint someone (referred to as your attorney) to make decisions on your behalf, either for personal, financial, or health-related matters. Getting a POA is an important step in planning for the future, as it ensures that someone you trust will be able to handle matters … Read More